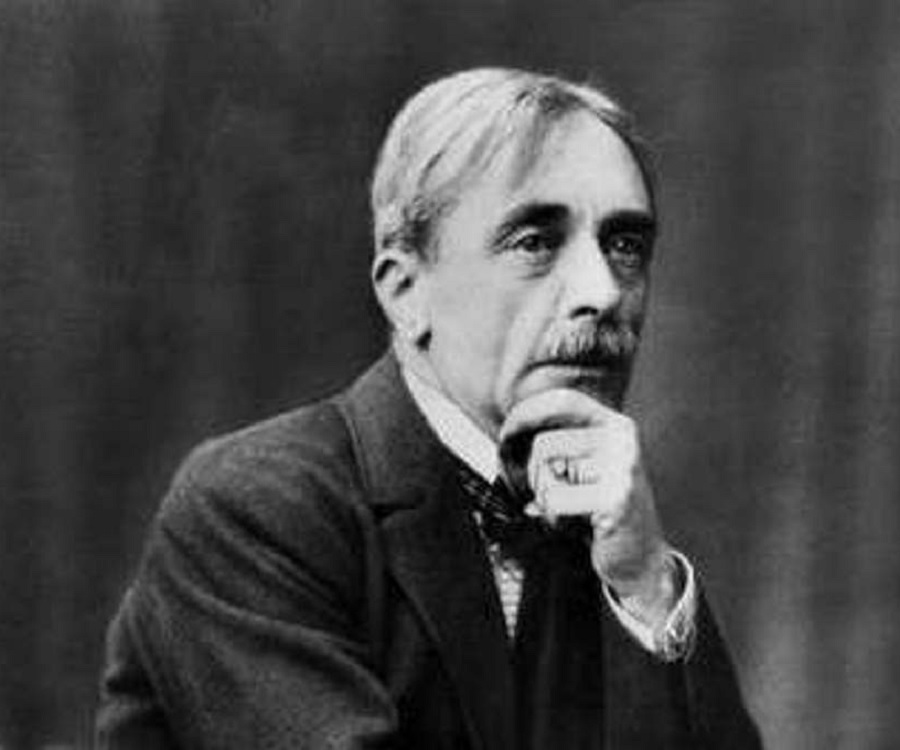

Paul Valéry : la biographie non-officielle

Paul Valéry est un écrivain, poète, essayiste et philosophe français. Il est né le 30 octobre 1871 dans la ville de Sète et est mort en été 1945, le 20 juillet. Découvrez ici la biographie complète de cet artiste.

Études et débuts d’un poète

Après des études primaires dans l’ordre catholique des Dominicains, ordre catholique, de sa ville natale Sète, il poursuivit avec des études secondaires dans la ville de Montpellier. Avec un amour prononcé pour la mer, il renonça toutefois à préparer son entrée à l’Ecole Navale. Il commença par étudier le Droit en 1889, année durant laquelle ses premiers écrits furent publiés dans la Revue maritime de Marseille. Durant ses études de Droit, il rencontra Pierre Louÿs, poète et romancier, qui fut comme un « directeur spirituel » en plus d’un ami. Il rencontra aussi deux autres grandes figures de la littérature française, Gide et Mallarmé.

Paul Valéry est un poète symboliste, en réaction au naturalisme, cette mouvance est un courant artistique qui pose ses fondations sur l’idée que monde réel se reflète dans une réalité supérieure dont l’artiste intervertit par des ressemblances suggestives.

La nuit de Gênes et ses conséquences.

La nuit de Gênes marqua chez Valéry, le début d’une longue période de « silence poétique ». En effet, le poète, ce soir là, eu une sorte d’illumination. Etant très proches du cercle mallarméen, il ne souhaitait pas être considéré comme un « sous Mallarmé ». Le poète n’aimait pas ce cercle où il y avait sans cesse des obligations. Il n’appréciait pas toutes ces mondanités, c’est pourquoi il prit toujours du recul par rapport à cela.

L’année 1991 fut aussi marquée par la disparition d’Arthur Rimbaud et Valéry, qui avait une admiration pour ce poète, vit naitre en lui, une réflexion sur la dimension d’arrêt.

Durant sa période d’arrêt d’écriture poétique, il fur rédacteur au ministère de la Défense, anciennement de la Guerre. Paul Valéry, quand bien même son statut, connaissait le manque financier, ce qui le poussa à écrire juste pour écrire, il devint une sorte de fossoyeur de l’écriture, tout cela, pour vivre. C’est à cette même période qu’il entreprit la rédaction des Cahiers.

En 1900, il épousa Jeannine Gobillard avec qui il aura 3 enfants.

C’est en 1917 et poussé par Gide, que Valéry réapparaitra sur la scène poétique et que va s’enchainer une ascension de titre.

Célébrité dans une ère tourmentée

De 1920 à 1930, Paul Valéry, dont la notoriété devient incontestable bien son rejet pour celle-ci, enchaina les apparitions en public, les conférences. Il succéda en 1925 à Anatole France à l’Académie Française, institution française chargée de normaliser et perfectionner la langue française depuis son officialisation en 1635 par le cardinal de Richelieu. Il eu par la suite, beaucoup de nomination :

Paul Valéry s’illustra aussi pour sa force de conviction et la défense de ses valeurs en refusant d’attribué au maréchal Pétain en 1941, les félicitations de l’Académie pour sa rencontre avec Hitler. Ne voulant collaborer, il perdit sa place au sein du centre universitaire de Nice.

Malheureusement, une fois la guerre terminé, Paul Valéry s’éteignit le 20 juillet 1945 à Paris, semaine où le procès du maréchal Pétain s’ouvrit.

Suite au souhait du général de Gaulle pour des funérailles nationales, Paul Valéry trouva son repos éternel dans sa ville natale, Sète et ce cimetière marin, dont la passion ne l’a jamais quitté.